March 1, 2016

Burberry’s adoption of instafashion – making everything on its catwalks available to buy online immediately after the show – has forced luxury brands to evaluate their selling and marketing techniques. But since customers may not want to buy a £75,000 bottle of perfume online, how does a digital interaction enhance a luxury buyer’s experience?

“I don’t think any of the luxury brands are doing [digital] at all well,” Michael Ward, CEO of Harrods, said. “If you try and go on one of the super-brands sites and buy something, you’ll have lost the will to live before you finish.”

Harrods’ CEO Michael Ward and Clive Christian’s group CEO Amy Nelson-Bennett discuss the impact of digital on marketing luxury.

Ward joined Gordon Clark, Managing Director UK & Ireland, Global Blue; Vartkess Knadjian, CEO, Backes & Strauss; Amy Nelson-Bennett, CEO, Clive Christian Group; and Deborah Aitken, Bloomberg Intelligence’s Senior Industry Analyst at Bloomberg’s European headquarters for a discussion around the current state of the luxury goods market with luxury association Walpole.

Aitken echoed Ward’s statement, noting that the lack of an e-commerce platform can leave luxury brands vulnerable, especially in Europe. Fluctuations in the euro and the pound make both visiting and buying abroad less attractive to foreign vacationers. In more extreme cases, Aitken said, LVMH saw tourists numbers halved to its stores after the terrorist attacks in Paris.

“If you try and go on one of the super-brands sites and buy something, you’ll have lost the will to live before you finish.”

However, many luxury brands aren’t complementing their retail store experience with a digital one. Online sales account for just 6 percent of the luxury goods market, Aitken said. Plus, only half of major brands have complete browse-to-buy online services.

Online sales account for just 6 percent of the luxury goods market, according to Bloomberg Intelligence.

Even if a luxury purchase happens in a retail store, brands must do more to get them in the door. Gordon Clark, Managing Director UK and Ireland for Global Blue, said 75% of traveler purchasing decisions are made before the journey even starts: shoppers investigate brands via mobile applications, search engines and social media.

“In the past, we were marketing and competing with the shop next door, but now we’re competing against a store in Paris, a store in Japan,” Clark said. “Digital is really important because it’s about how you get your quality, your expertise, your exclusivity, your heritage, your service… across to make people say, ‘I’m going to buy that product, but I’m going to buy it in London’.”

“Digital is really important because it’s about how you get your quality, your expertise, your service…"

This is part of why Burberry is changing its marketing to show off its collections on Snapchat and to live-stream its shows. The brand is building a relationship between the runway and "the moment when people can physically explore the collections for themselves”, Burberry’s CEO Christopher Burgess told Bloomberg’s fashion and retail reporter Kim Bhasin.

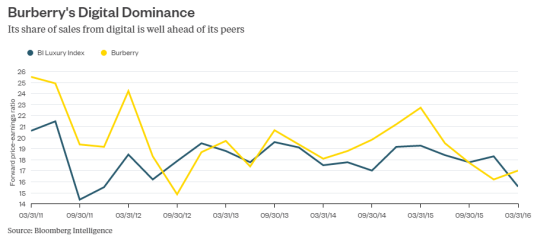

How digital sales give Burberry an advantage, according to Bloomberg Intelligence. (via Bloomberg Gadfly)

Will luxury e-commerce ever replace the act of choosing or purchasing a luxury item in person? That’s not the point, Ward said.

“Are we ever going to replicate that amazing experience of a woman buying a Birkin bag and being the first person to touch it? No, we’re not,” he said.

“But what we do create is content, so when we have a show, you hear about the show and what’s hot. It’s a different way of engaging the customer in the brand. The digital customer has a different relationship to you, and it’s about understanding the different paths to market that will make us successful.”

Read next: Bloomberg Intelligence on balancing tradition and digital in the luxury goods market

Then read: Bloomberg Intelligence explores the year ahead in advertising